Business Insurance in and around Cincinnati

Get your Cincinnati business covered, right here!

Helping insure small businesses since 1935

Business Insurance At A Great Price!

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Shelonda Payton help you learn about terrific business insurance.

Get your Cincinnati business covered, right here!

Helping insure small businesses since 1935

Cover Your Business Assets

If you're looking for a business policy that can help cover accounts receivable, business liability, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

Reach out to the wonderful team at agent Shelonda Payton's office to discover the options that may be right for you and your small business.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

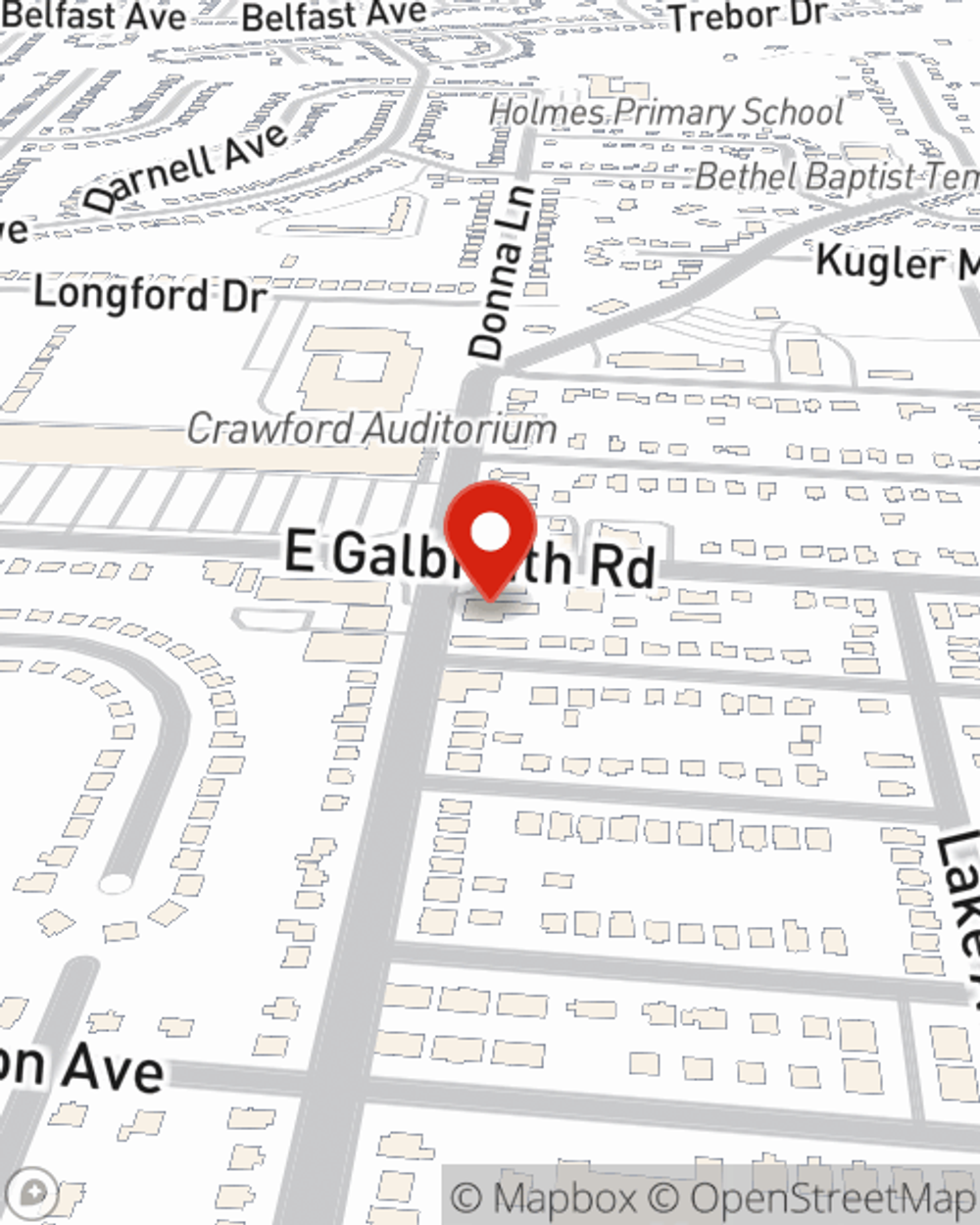

Shelonda Payton

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.